Sky Bridge Advisory Created Its Retirement Planning Practice After Advising A Growing Number Of Professionals And Entrepreneurs Facing Post-Career Uncertainty. Most Had Capital—But Lacked Structure. Some Had Portfolios—But No Clear Income Pathways. We Built A Model To Address This Gap.

Founded To Serve UAE-Based Professionals, Global HNWIs, And Family Business Heads

Designed For Mid-Career And Late-Career Planning—Not Just Post-Retirement Advice

Backed By Experts In Wealth Design, Tax Planning, And Succession Frameworks

Helps Clients Prepare Emotionally And Financially For A Post-Employment Lifestyle

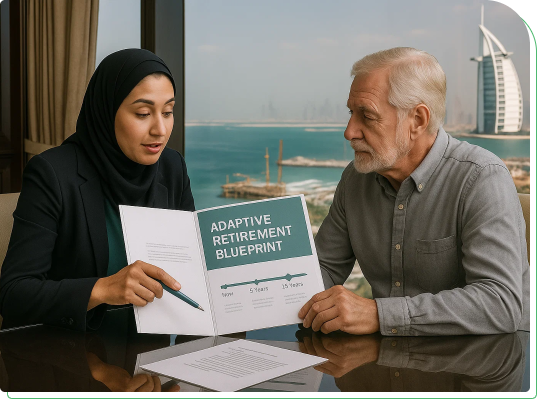

We Don’t Begin With Products—We Begin With Questions. What Does Your Ideal Post-Work Life Look Like? Where Do You Plan To Live? What Income Streams Already Exist? Our Approach Turns Those Answers Into A Living, Trackable Plan.

Retirement Blueprints Are Built Around Lifestyle Goals, Not Assumptions

Income Need Analysis Considers Inflation, Healthcare, Dependents, And Geography

66% Of Plans Recalibrated After Stress Testing Legacy Income Sources

Planning Includes Real Estate, Pensions, Business Assets, And Non-Financial Dependencies

Retirement Looks Different For Every Career—And Every Passport. We Build Segmented Retirement Plans Based On Client Category, Residency Exposure, And Income History.

Executives With Employer-Provided Pensions And Deferred Equity

HNWIs Planning Return Migration Or Dual-Country Retirement

Entrepreneurs Preparing To Exit And Shift To Passive Income

Real Estate-Heavy Portfolios Looking To Convert Assets To Income

Women Professionals Planning Retirement Security Post-Career Breaks

Senior Expats Needing Healthcare-Focused, Relocation-Aligned Planning

At Sky Bridge, Retirement Isn’t A One-Time Decision—It’s An Evolving Roadmap. Our Plans Are Dynamic, Multi-Asset, And Tax-Conscious, With Clear Timelines And Checkpoints.

Post-Retirement Income Mapped By Liquidity Tier, Tax Exposure, And Risk Appetite

Integration Of Annuities, Pensions, Drawdown Funds, And Offshore Instruments

Healthcare Planning, Emergency Buffers, And Repatriation Protocols Included

Annual Recalibration Based On Lifestyle Shifts, Market Conditions, Or Family Changes

Sky Bridge Advisors Are Not Here To Push Products—They Are Trained To Preserve Dignity, Choice, And Freedom In Retirement. If A Solution Doesn’t Protect Your Future, We Won’t Recommend It.

Product-Agnostic Advisory Focused On Post-Retirement Peace Of Mind

No High-Risk Instruments Unless Backed By Risk Appetite Testing

100% Transparency On Cost, Lock-Ins, And Liquidity

Retirement Is Personal—And We Treat It That Way